It is calculated in relation to the description of the activity carried out (and not according to the turnover), which is the tax paid for the calendar year, that is to say from January 1 to December 31, even if the activity ceases. during the year.

What are the different types of taxes?

What are the different types of taxes in France?

- 1) Income tax (IR)…

- 2) Real Estate Wealth Tax (IFI)…

- Property tax. …

- September 15, 2021. …

- September 20, 2021. …

- October 15, 2021. …

- October 20, 2021 …

- October 25, 2021

What are the different types of indirect taxes? Definition of the word Indirect taxes Indirect tax is a tax contribution collected by the public treasury. … The best-known indirect tax is VAT. A company that sells goods or services is a taxpayer, it is the company that pays VAT to the tax authorities.

What are the annual taxes? The amount of income tax is calculated at the rate: 5% for legal persons. 15% leave for individuals.

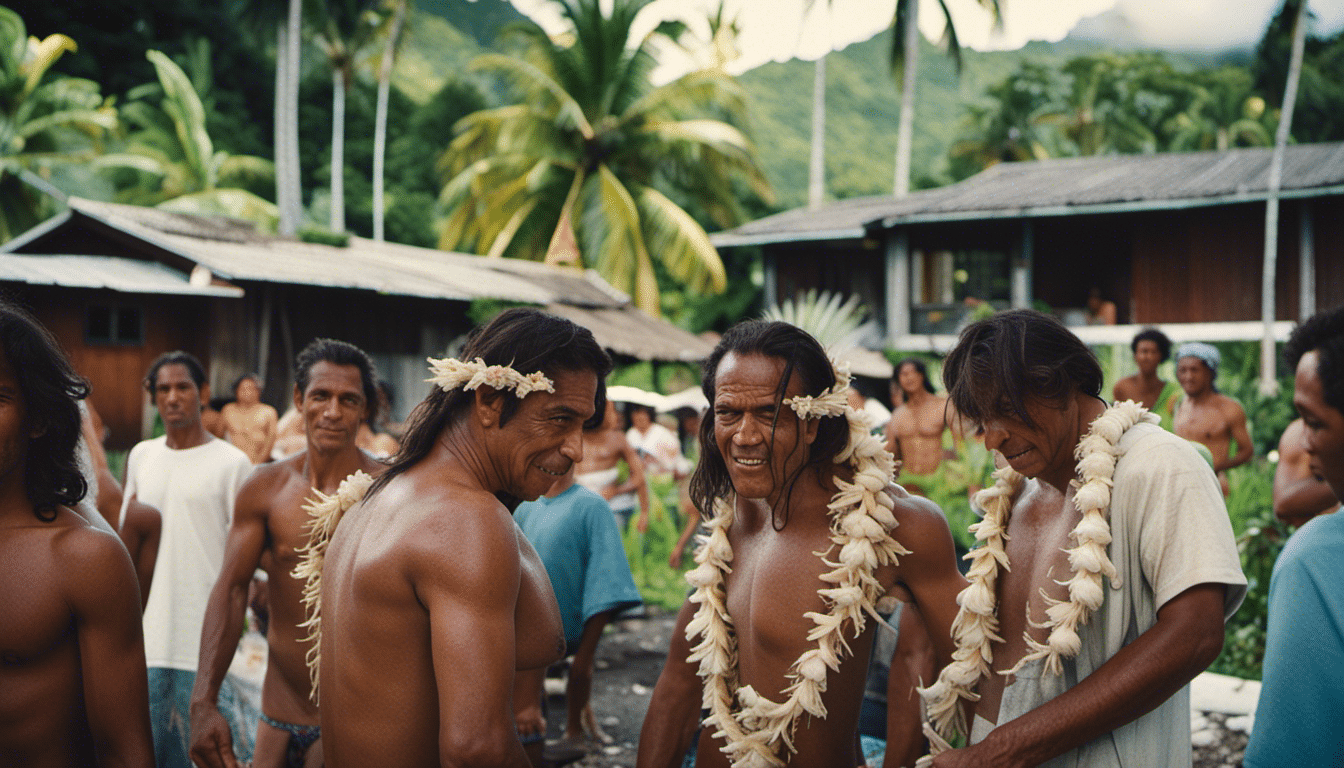

What status for Tahiti?

1984: First Statute of Internal Autonomy In accordance with article 1 of Law no. 84-820 of September 6, 1984, the territory of French Polynesia constitutes “an overseas territory endowed with internal autonomy within the Republic”.

How to open a business in Tahiti? In French Polynesia, any creation of a sole proprietorship and business must go through the Business Formalities Center – CFE, affiliated to the CCISM of the Chamber of Commerce, Industry, Services and Commerce.

How to get a license in Tahiti? As part of your DICP activity, you will need to provide proof of identity and a duly completed patent contribution form, which you can find by clicking here. This declaration must be made within 3 months of the start of the activity.

Why take out a license?

Registration on the list of licenses is compulsory for all unemployed people with the exception of farmers for the sale of their raw products, fishermen, artists (sculptors, engravers, painters, etc.), and owners who rent their Property.

Why have a patent? In France, the company card is a direct tax to which any company or person regularly exercising an independent professional activity is subject. … The purpose of the permit is then to tax the presumed income according to the work tool.

Who has to pay for the license? Who has to pay for the carrier’s license? Any person, natural or legal, carrying out public transport of persons or goods.

What is the patent rate in Cameroon?

| BASIS CALCULATION | % | PODA CONTRIBUTION |

|---|---|---|

| Turnover of large companies | 0.159% | 5,000,000 |

| Average turnover | 0.283% | 141,500th most common |

| Very low turnover | 0.494% | 50,000 |

Who has to pay for the license? It is a tax paid by any natural or legal person who exercises an independent professional activity for profit.

What is a patent in Cameroon? A license is a municipal tax paid annually by any natural or legal person exercising a commercial, industrial or any other profession which is not included in the exemptions provided for by tax law.

How to liquidate the patent?

Persons carrying out the activity subject to approval, even in the event of exemption, are required to make a written declaration to the competent tax office within ten (10) days of the start of the activity.

How to liquidate a license? In case of loss or destruction of the patent certificate, the taxpayer must report it immediately to the tax authorities. A duplicate of the original of the certificate is issued to him with payment of a special fee of 25% of the fixed fee.

How to calculate the permits due? The tax rate on the value of the rent is 18.5%. For installations not located on the municipal territory, the rate is 16%. However, the due date for the customs duty on the value of the rental must not be less than 1/3 of the customs duty on the turnover.

How did Polynesia become French?

In 1791, Admiral Marchand captured the Marquis on behalf of the King of France during a colonial battle between French and English in the Pacific. … France imposed itself on Tahiti in 1842 by establishing a protectorate which included the Windward Islands, the Leeward Islands, the Tuamotus and the Australian Islands.

Who colonized Polynesia? The French colonization of Polynesia began in May 1842 when Admiral Abel Aubert du Petit-Thouars, head of the French fleet in Oceania, annexed the Marquesas on the advice of Jacques-Antoine Moerenhout.

Who delivers Tahiti from the British? The first European to discover Tahiti was in fact British Lieutenant Samuel Wallis, who landed on June 19, 1767 in Matawai Bay, located in the territory of the Paré (Arue/Mahina) government, led by Chief Oberea (or Purea). ). Wallis named the island King George.

Who should pay the taxes?

All economic entities (natural or legal persons exercising an economic activity) pay taxes in France. Taxes are multiple and mainly affect households and businesses.

What is an Income Taxpayer? Income. Persons domiciled in France are subject to French income tax on all their income from French and foreign sources, regardless of their nationality.

How do you know if you pay taxes? From your private area on www.impots.gouv.fr, you can consult your payments in the “Payments” section then in “Taxes”: click on “Access”.

How to cancel a Tahiti patent?

To unsubscribe, you must therefore systematically attach the following required documents: 1 copy of a valid identity document or passport 1 printed P3 (Company Unsubscribe Statement) 1 nominal force in the original signed by the representative of the Corporation.

How to stop a patent? In order to proceed with the closure of his auto-entrepreneur, the auto-entrepreneur must begin with a declaration of his definitive transfer of business to the business formalities center (CFE) on which he depends. This formality, completely free, can be done online or by mail.

How to obtain a license in Polynesia? In French Polynesia, it is paid by any natural or legal person of French or foreign nationality who exercises a permanent or temporary independent professional activity, which does not fall within the exemptions provided for by the Polynesian Code.

How is it going for the patent in New Caledonia?

Guichet-entreprises.nc allows you to take all the necessary steps to establish private property and to take out a license online, without having to travel and use a single form. This is the first step to making life easier for entrepreneurs!

What are the steps to settle in New Caledonia? To settle or reside in New Caledonia, French citizens must be in possession of a valid passport (valid for 6 months from the date of entry into the territory). An identity card is not enough.

How do you know if someone is independent?

A self-employed person is therefore a natural person who exercises his profession outside employment contracts or employee status. That’s a big difference with an employee. As a freelancer, you do not work under any authority. You are free to organize your work as you wish.

How do you know if a person is employed? If your employer declares your activity to Urssaf, it is he who gives you your pay. If you have any doubts about the application, contact Urssaf, on which you depend.

How to justify a self-employed? How can you justify your self-employed status if the civil status certificate differs from that of the payment plan? To subscribe, in particular to the municipality of Madeleine, the TNS must prove its status by submitting a certificate of civil status.

Who can have a license?

In France, the company card is a direct tax to which any company or person regularly exercising an independent professional activity is subject.

How to get a license in Haiti? How can I get a license? The taxpayer is required to file a certificate on his license at the office of the General Tax Department (DGI) of the municipality where he exercises his professional activities.

Who has to pay the license in Senegal?

Contribution to licenses: paid by any person carrying out a commercial, industrial or professional activity in Senegal, excluding persons carrying out remunerated activities within the meaning of labor law.

How is the license calculated? CODES AND NATURE BASIS OF THE PATENT Premises and land are coded according to their nature from 21 to 26. The rates used to calculate the rental value are rate 1 for industrial facilities and rate 2 for traders and service providers.

Who has to pay taxes in Senegal? The progressive rate is increased from 0 to 40% and applies according to income class. For example, the maximum rate is more than 13.5 million CFA francs per year. However, you are entitled to a number of benefits, for example for your family situation.