Introduction

The modern payment solutions offered in Tahiti are a must for this French overseas department. Many retailers and other businesses are turning to new technologies to facilitate their transactions with their customers. Modern and alternative means of payment make the transaction process faster and more efficient for buyers and sellers, and also offer higher levels of security. When it comes to how to pay in Tahiti, there are many options. This article explains some of the most commonly used payment methods for conducting online transactions in Tahiti, and the pros and cons of each.

The main payment solutions in Tahiti

Companies and shops in Tahiti offer different online payment solutions to meet the needs of their customers. The most common methods are the cash payment, TEA payment by credit or debit card, more bank transfers and wire transfers.

Cash payment

Cash payment is the oldest and most widespread method of payment in Tahiti. It has several advantages, among which:

- No bank account required to make payment

- The customer can control the amount he pays

- Security, because the customer knows exactly what he is buying

This payment method is made very quickly and is particularly convenient for everyday purchases. The main limitation of paying in cash is the need to have enough cash on hand to make a purchase.

Payment by credit or debit card

Credit or debit cards are another popular alternative for purchases in Tahiti. They allow shoppers to pay online or in-store using their credit or debit card. The main advantages of this payment method are:

- Increased security through data encryption protocols

- Easier to manage than cash payments

- Allows the buyer to control their expenses

The main limitations of paying by credit or debit card are banking service and interest charges applied to certain types of cards.

Bank transfers and wire transfers

Bank transfers and wire transfers are usually made using a bank account and are another popular method of online payment in Tahiti. They offer buyers and sellers a fast and secure way to transact. Some of their main features are:

- Instant access to money

- Retention of Seller and Customer Transaction Information

- Protection of personal and banking information of customers

- Minimum transaction fees

However, bank transfers and wire transfers may take longer than other payment methods. They also require opening an account and setting up an email address, which can be a barrier for some users.

Other payment solutions offered in Tahiti

Companies in Tahiti offer their customers various payment solutions in addition to cash payment, bank cards and bank transfers and wire transfers. Here is a non-exhaustive selection:

Bank checks

Bank checks are another method of payment that is available in most stores in Tahiti. This method is very secure, and customers can, among other things, control exactly the amount paid and choose their own words so that the beneficiary can verify that the check is legitimate. However, checks are slow to cash and can take 3 to 5 days to be cleared by the bank.

Payment by prepaid card

Prepaid cards are another popular payment solution, and they’re mostly used for small transactions that don’t require a bank account or credit/debit card. Prepaid cards are available at bank ATMs or in shops and gas stations. The amounts paid can be used immediately and they also provide additional security as they can be recovered in the event of loss or theft.

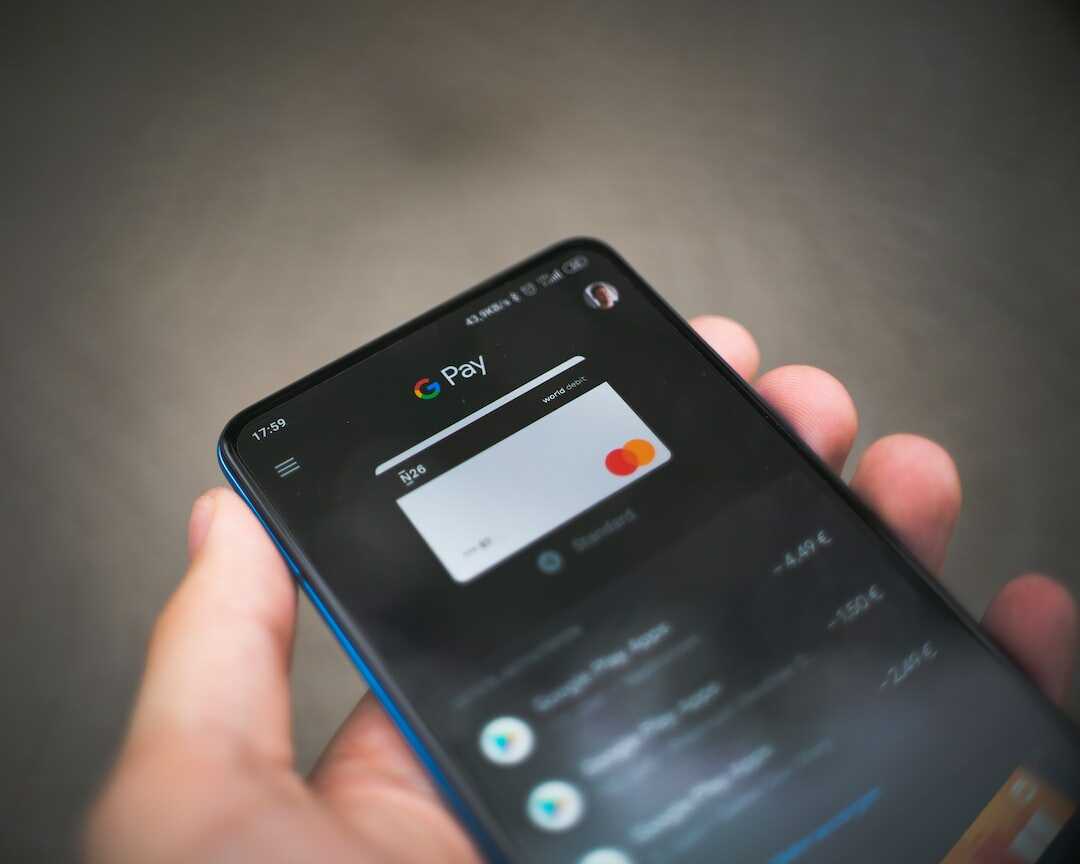

Mobile payment (M-Payment)

M-payment is an online payment method that is being deployed in Tahiti. Customers can make payments on dedicated apps using their smartphone or tablet. The main advantages of this payment method are security, convenience and speed. Indeed, mobile payment allows users to pay in seconds and without having to enter additional information.

Comparative table of payment solutions in Tahiti

| Means of payment | Benefits | Disadvantages |

|---|---|---|

| Cash payment | Quick and convenient No bank account needed | Limit of amount available |

| Payment by credit or debit card | Increased security Better control of expenses | Bank service charges and interest |

| Bank transfers and wire transfers | Instant access to funds Maintenance of transaction information | Complex and long process |

| Bank checks | Increased security Control of the amount paid | Long and inconvenient process |

| Payment by prepaid card | Ease of use Additional security in case of loss or theft | Limit of amount available |

| Mobile payment | Security and Convenience fast payment | Limit for some entities |

What are the best payment solutions in Tahiti?

It is difficult to determine which is the best payment solution in Tahiti, because it depends on the type of transaction and the price of the good or service. For large transactions, payment by credit or debit card or wire or wire transfer is usually the most convenient and secure. It offers better protection of financial information and a possibility of recourse in the event of a fraudulent or unauthorized transaction. For everyday purchases or payments of small amounts, paying by cash is a convenient and secure option. Bank checks are also very safe and provide good control over expenses. Finally, prepaid cards and mobile payment offer additional security and unprecedented convenience.

Businesses in Tahiti now have the tools and technology to offer their customers a variety of modern and secure payment methods. Customers can choose the most suitable and convenient payment method for them based on their preferences and type of transaction.

In conclusion, there are many payment methods in Tahiti which are safe and offer buyers and sellers a higher level of security and greater convenience in their transactions. Businesses can now adopt these technologies and solutions to provide their customers with safer and more convenient shopping experiences. The best payment solution will depend on the preferences and needs of each customer and the transaction.