Credit card travel guarantees are often not recognized and can be very useful if you are having trouble abroad.

& # xD;

By – & # xD;

What do travel guarantees offer?

& # xD;

Yesterday at 1:00 p.m. & # xD;

– Reading time: & # xD;

& # xD;

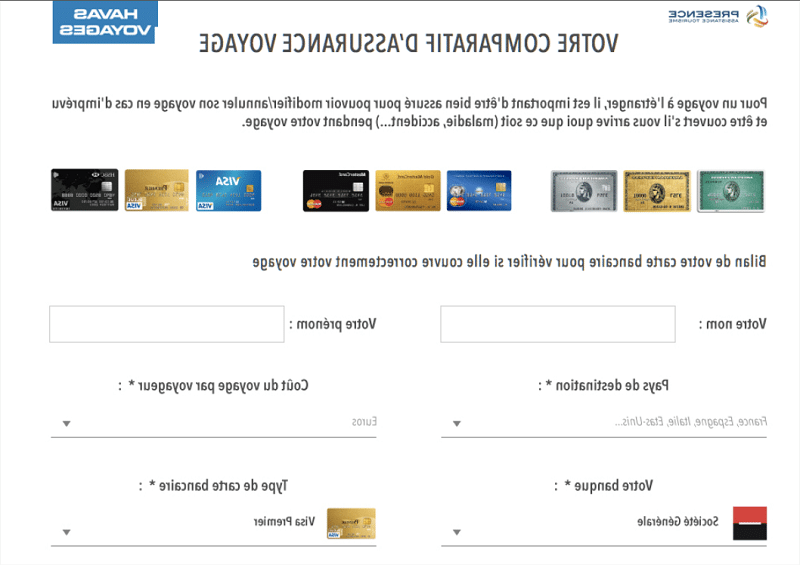

Some bank cards provide insurance and emergency services to their owners. But these guarantees will differ depending on the bank and the nature of your bank card (Premier or Gold), whether you have a Mastercard or a Visa.

Bank cards offer various insurance guarantees. But they will generally allow you to obtain compensation in various situations:

Travel guarantees thus cover the additional costs caused by these inconveniences.

How it works?

This is not always the case, but if you have a premium bank card and are abroad, you can contact certain emergency services.

These will be listed before you sign your contract and you may be provided with a support number. Keep this in mind as it can be useful if you have an accident that requires medical bills or even hospitalization. Contacting this number can initiate a support process.

What are the guarantees of the Mastercard card?

The amount of compensation is generally capped.

What are the advantages of the Mastercard card?

The more “high-end” your contract is, the wider the guarantees will be. The fees will also be higher.

What are the advantages of the Crédit Agricole Gold card?

Therefore, those who are used to traveling abroad prefer to opt for a contract with broad guarantees.

- For your credit card guarantees to work, you must carry out transactions related to the purchase of your plane ticket or the rental of your car with it.

- You should also contact the helpline number before incurring any charges or performing repairs to find out the specific scope of these warranties.

- If you pay for all or part of your ticket with your Classic Mastercard (plane, boat, train or vehicle rental), you and your family (whether you travel with you or not) will benefit from death and disability insurance if you spend more than 100 kilometers from home…

- There are several advantages to having this card: – You can set a limit per month. – You can pay anywhere in the world. – The money will only be debited from your current account the following month. – In some stores you have discounts.

- The advantages of the Gold card at Crédit Agricole

What are the advantages of the Mastercard Gold card?

Higher withdrawal limits.

How to use credit card insurance?

High payment limits.

How to get funded by MasterCard?

Insurance and assistance (cancellation, modification or interruption of trip, repatriation, hospitalization, etc.)

What are the advantages of the Visa Classic card?

Snow and mountain insurance.

How to make the Gold card insurance work?

Guarantees more comprehensive purchase protection.

What are the insurances of your credit card?

The advantage of the Gold card is that you can choose between immediate debit (bank account debited with fees) and immediate debit (bank account debited all at once at the end of the month). The limits of the Fortuneo Gold Mastercard credit card are: Withdrawal: 1000 € / 7 days. Payment: 2000 € / 7 days.

What are the advantages of a credit card?

Credit card insurance applies from the moment the trip (or part of it) is paid for with. In case of assistance, it is enough to have it with you and of course that the card is valid. However, credit card insurance may differ depending on the customer’s bank.

What are the insurances of the Visa Premier card?

The refund request must be sent to the card issuer with which the cardholder is contractually bound (in practice in France mainly the Visa, Mastercard, American Express and Paypal networks).

How does the cancellation insurance work?

With the Visa Classic card, you benefit from: comfortable payment and withdrawal capacity in France and abroad, access to the entire Visa network worldwide: your Visa Classic card is accepted by million traders.

How do I take out travel cancellation insurance?

Trip cancellation, modification or interruption cover – up to €5,000 per insured person per calendar year in the event of a guaranteed change in health occurring before the start of the covered trip. Plane and train delay guarantee 1 – Up to €450 per delay for costs incurred (meals, refreshments).

Which medical certificate for trip cancellation?

Travel: what are the insurance guarantees on your credit card? … The guarantee against loss or theft of luggage. Civil liability for damage caused to a third party (be careful, this generally only works abroad). Death and disability insurance.

What does travel cancellation insurance cover?

Another essential advantage of the bank card: it allows you to pay for your purchases on the Internet easily and in complete security. Typically, all you need to do is enter the 16-digit number on the front of your card, the expiration date and the security code on the back.