Many people are looking to survive on $500 per month or less, which can be difficult. It is possible to live with this budget by being judicious and having a little willpower. To help you survive, here are some tips for managing your money better, which can help you save and earn more in the long run.

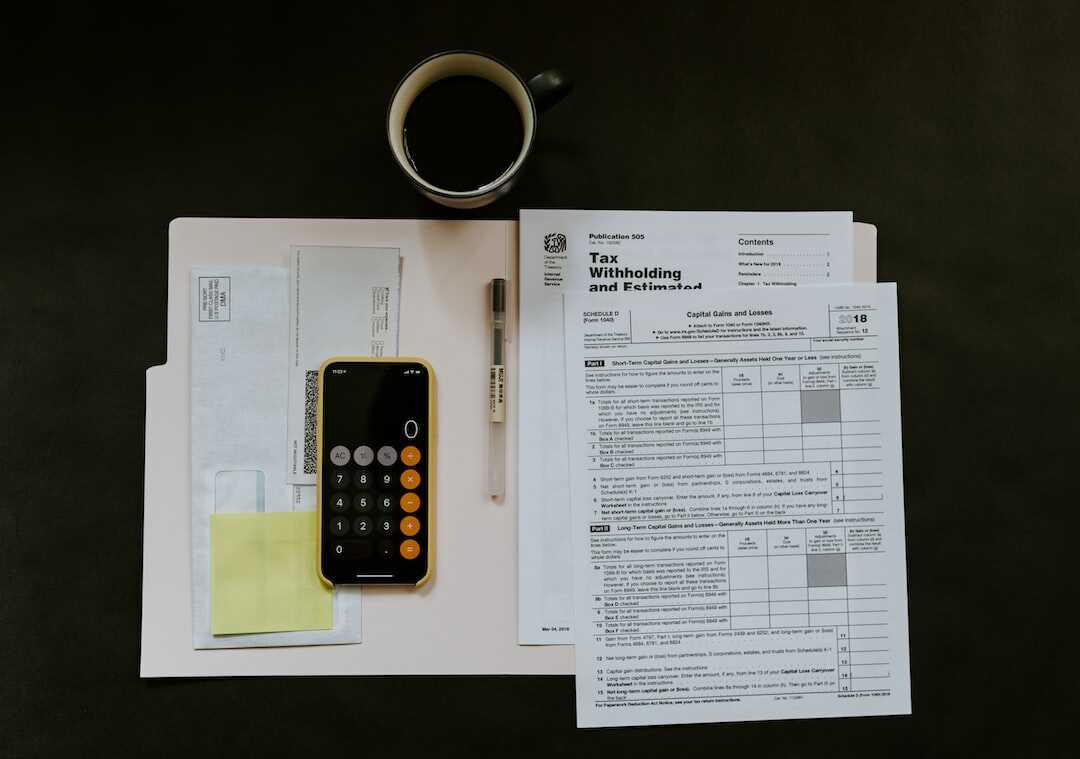

1. Understand and set your monthly budget

The first step to successfully budgeting with $500 per month is understanding how you manage your money and setting a monthly budget. Use a budget app like LemonWay or a spreadsheet to establish a detailed budget and clearly define your expenses. It’s important to check it regularly to see where your money is going and how you can save.

2. Track expenses

Once you’ve set a monthly budget and figured out where you’re spending your money, you’ll need to monitor your budget and spending regularly. If you are spending more than expected, you will need to find ways to reduce your expenses. For this, you can use mobile applications such as moolineo, which allow you to track your spending and see where you can cut back.

3. Use cashback apps

Another way to help you manage your budget better is to use cashback apps, which reimburse you with money for every transaction you make. You can use apps like iGrail Gold Ebates. These apps give you discounts on purchases you wouldn’t otherwise be able to get.

4. Avoid impulse buying

When planning your budget with 500 euros per month, it is important to avoid impulse purchases. These purchases may seem appealing at the time, but they can cost you a lot more in the long run. That’s why it’s important to have a well-thought-out shopping list and not buy things you don’t need.

5. Shop smart

To better manage your budget with 500 euros per month, you will have to shop smartly. Go to websites that offer products or services at affordable prices. Consider the age and quality of the product before buying it. Avoid products that can go out of style quickly or will be hard to resell unless you can make a profit from them.

6. Stay organized

Stay organized by raising your bills and avoiding being caught off guard about your bills. You need to establish a system so that you can identify your financial obligations so that you can settle them on time and ensure that you have paid them well. If you are unable to make a payment on time or have forgotten an invoice, you may have to pay additional fees, which can put a strain on your budget.

7. Avoid additional debt

If your budget is 500 euros per month, avoid taking out new loans or taking on new debt. You need to make sure you have enough money to pay your bills. You may want to invest in things that will save you money in the long run, but avoid spending all your money on things that can wear out or go out of fashion quickly.

8. Learn to play the coupon card

Coupons can help you save money when it comes to expenses. Find coupons and discount codes on clothing stores, groceries, and more. and try to find coupons for stores and restaurants you visit often. You can also buy gift cards and rewards cards at stores to save.

9. Plan a weekly outing

To avoid boredom when you’re on a tight budget, plan at least one weekly outing. You don’t have to spend a lot of money to have fun and you can find fun and affordable activities. You can organize family outings with activities like playing games, going to parks, watching movies, etc.

Another tip for surviving on $500 a month is to save for the future. Set long-term goals and save for those goals. You can open a savings account and save at least 10% of your salary each month, which will allow you to achieve your long-term goals.

With 500 euros per month, it is not impossible to survive. The key is to successfully manage a tight budget. To do this, it is essential to draw up a financing plan and put in place solutions to save 1000€ per month. Avoid unnecessary purchases and plan your spending so you don’t go over budget. Try to find ways to earn extra money, such as one-off assignments or volunteer activities. Practicing wise saving and investing can help you achieve your financial goals.

11. Use apps to help you save

There are financial apps that can help you manage your money better and save money. For example, yolt helps you track finances and save money by setting goals. You can also use apps like Toshl to better manage your money and expenses.

With a little effort and discipline, you can survive on $500 a month. Use these tips to learn how to better manage your money and save money. It may take time and effort, but it is worth it. With a little patience and good budget management, you can save money and be successful with your budget.